Monthly VAT or GST invoices can be downloaded from the Skype Manager admin dashboard for specific allocations made. You can download your VAT or GST invoice for a given month on the 5th of the next month; invoices will be available for six months.

You can learn more about how Skype charges VAT or GST here.

VAT or GST invoices are available to download for admins in the following countries:

- Bulgaria

- Cyprus

- Denmark

- Estonia

- Hungary

- Italy

- Latvia

- Lithuania

- Malta

- Portugal

- Romania

- Slovenia

- Spain

- Switzerland

We do not charge VAT or GST when you buy or allocate Skype Credit, so these transactions are not reflected on monthly VAT/GST invoices. Allocations of subscriptions or Skype Numbers are charged VAT or GST, so you will see these transactions recorded on monthly VAT/GST invoices.

Your members’ transactions (Skype Credit usage for calls, SMS or Wi-Fi as well as purchases made with allocated Skype Credit) will incur VAT or GST if the registered billing address of the personal linked account is in a country where VAT or GST is applicable. Monthly VAT invoices for members’ transactions are available in certain countries. Learn more.

Other Skype Manager reports are available on the admin dashboard.

To download a monthly VAT/GST invoice:

- Sign in to Skype Manager admin.

- Click Reports from your Skype Manager Dashboard.

- Click Invoices.

- Select the month for which you require a VAT/GST invoice and click Download to save the invoice for the allocation in PDF format.

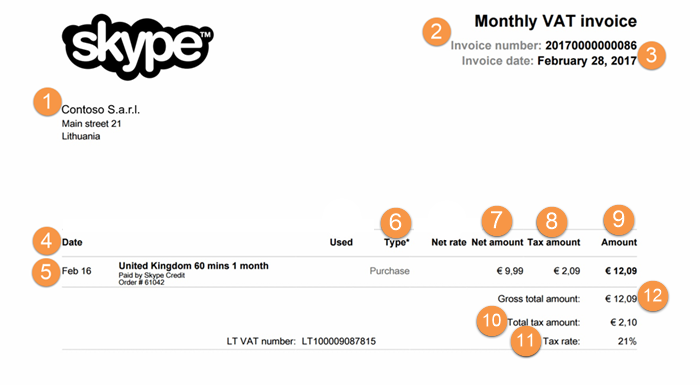

The following is an example of a VAT/GST invoice with each column explained in detail.

<

- Customer Details: your name and address

- Invoice Number: unique invoice identifier

- Invoice Date: usually the last day of the month

- Date: Date of the transaction

- Description: Calls you made or purchases you made

- Type: The type field lets you know if the item is a purchase, a call, or an SMS

- Net Amount: The amount paid for the item

- Tax Amount: The amount of VAT/GST paid for the item

- Amount: Total amount paid including VAT/GST for the item

- Total Tax Amount: total amount of VAT/GST paid for the month

- Tax Rate: the applicable tax rate used to calculate VAT/GST

- Gross Total Amount: total amount and VAT/GST paid

Skype Manager

VAT

VAT invoice

invoice