VAT and GST invoices are only available for the following countries:

-

Brazil

-

Bulgaria

-

Cyprus

-

Denmark

-

Estonia

-

Hungary

-

India

-

Indonesia

-

Italy

-

Latvia

-

Lithuania

-

Malta

-

Mexico

-

Portugal

-

Romania

-

Slovenia

-

Spain

-

Switzerland

-

Turkey

For a non listed country, the VAT or GST invoice is not available to download, but there is a detailed breakdown of all the Skype transactions and activities available in the monthly statement .

Note:

Skype Manager administrators who require VAT or GST invoices should

read this article

.

You can download the monthly VAT or GST invoices for a given month on the 5th of the next month. Keep in mind that Skype Credit on monthly invoices reflects actual credit used, not the amount purchased.

To download your VAT or GST invoice:

-

Sign in to your account.

-

Click the Purchase history link under Billing and Payments .

-

Select the desired billing month.

-

Click the Download drop-down and select Monthly VAT Invoice .

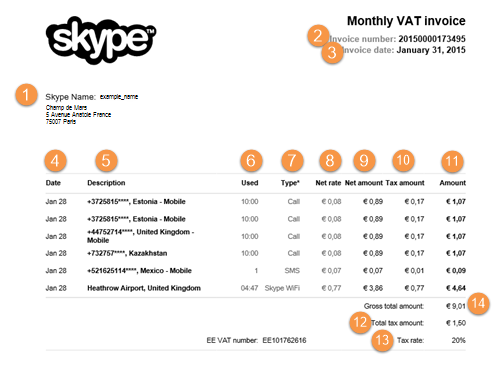

The following is an example of an invoice with each column explained in detail:

-

Customer Details : your name and address

-

Invoice Number: unique invoice identifier

-

Invoice Date: usually the last day of the month

-

Date : date of the transaction

-

Description : calls you made or purchases you made

-

Used : call duration or number of SMS sent

-

Type : lets you know if the item is a purchase, a call, or an SMS

-

Rate: unit cost (per-minute for calls, or per-message for SMS) for each item

-

Net Amount: the amount paid for the item

-

Tax Amount: the amount of VAT or GST paid for the item

-

Amount : total amount paid including VAT or GST for the item

-

Total Tax Amount : total amount of VAT or GST paid for the month

-

Tax Rate : the applicable tax rate used to calculate VAT or GST

-

Gross Total Amount : sum total amount and VAT or GST paid

VAT

invoice

VAT invoice

tax